Why Net Worth EXPLODES After $100K

Charlie Munger, the right hand man of Warren Buffett, has a famous saying: “The first $100,000 is a bitch, but you gotta do it. I don’t care what you have to do, find a way to get your hands on $100,000.”

Sep 30, 2024

Business

8 min

Capital Scales

The first principle to understand is that capital scales really well. What do I mean by this? I’m referring to the idea that the benefits or the returns from having capital increase proportionally as the amount of capital itself increases.

For example, if you were to invest $100 dollars in the stock market, or some other investment, you’re taking on some risk and at the end of the year, pretend you get a 10% return on your money. You’d have an extra $10 in that case. For most people, we can all earn at least $10 an hour doing SOME sort of job or task - so in this case, you risked $100 of your hard earned money for one year and you have $10 to show for it. Not that powerful.

Now let’s pretend you had $100,000 in the stock market. You take on the same risk as you did earlier on, and get a 10% return. At the end of the year, that amounts to $10,000 dollars.

Time Between $100K Gets Faster

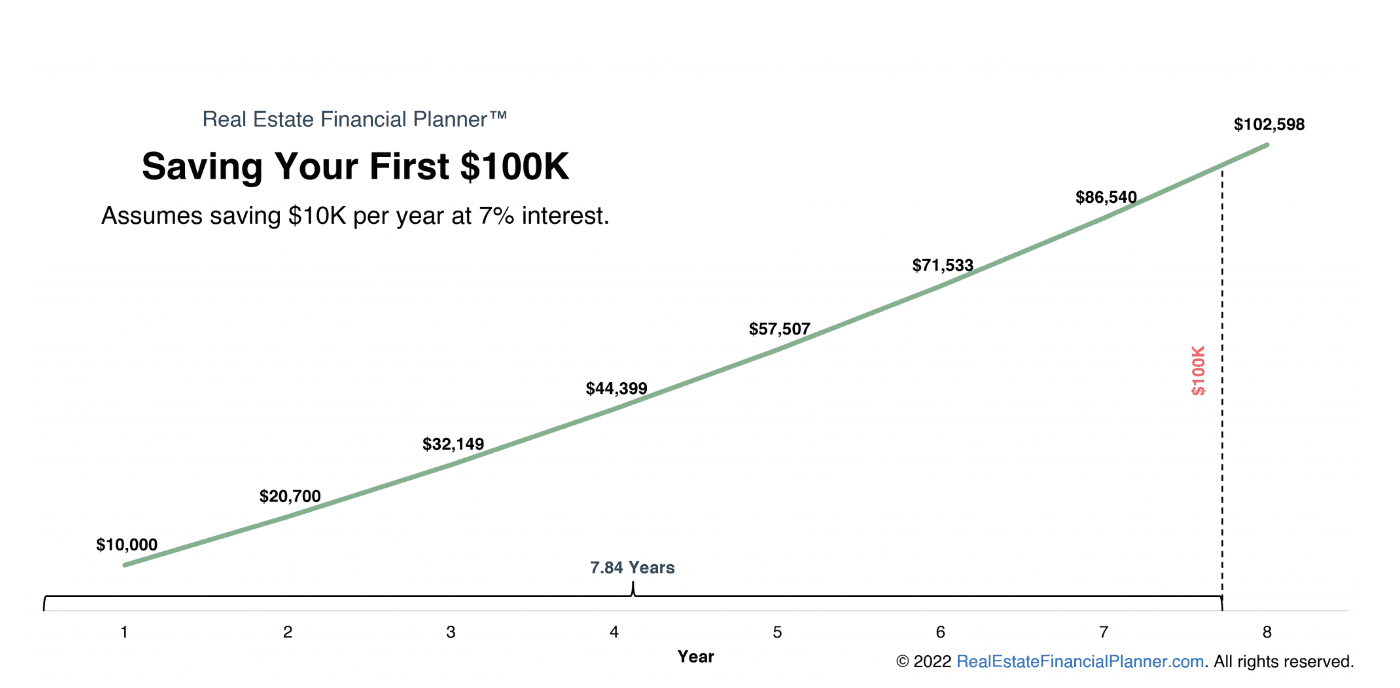

Pretend you save $10,000 a year and you get a return of 7%. The stock market averages about 8-10% a year, but lets use 7% because of taxes and any fees. Saving your first $100K will take roughly 7.84 years - If you save $10k each year and invest it.

If you think that saving 1 million dollars would be 7.84 years x 10, you would indeed be mistaken, in fact, it takes a fraction of that to get to $1 million - which we’ll answer shortly. Let’s look at how long it takes to get to $200K.

After you have $100k, getting to $200k total would only take you 5.1 years, because now your initial $100K is generating you interest, and you’re still keeping at it with the $10k in contributions every year.

Fast forward to your first $500k, and you can see that each $100K is faster than the previous. You’re responsible for contributing only $10K per year while the money you have invested continues to work for you at 7% per year.

The first 100k takes 7.84 years, the second takes 5.1 years, the third takes 3.78 years, the fourth takes 3.01 years, and the fifth takes 2 1/2 years

When you finally get to that $1 million dollar mark, after all is said and done, it will have taken you about 30.74 years with our assumptions. But take a look at the breakdown of time.

The first $100k took 7.84 years, or 25.5% of the TOTAL time it took to get to a million dollars, and the remaining $900k took 74.5% of the time.

And isn’t that funny? That means your wealth accumulation is DISPROPORTIONATELY a lot slower in the beginning.

Contributions

Contrary to what people believe, the first $100K is typically not derived from just investment returns in the market. If you save $15,000 a year for 6 years and you’re also able to attain a modest 4.5% return on your savings - you would be at $105K after 6 years but 85% of that would have been comprised of savings, and 15% is interest.

In another example, let’s say you save $10k a year, but you average a 10% return. It will take you 7 years and at a 10% return, savings comprise 67% of the total $104K here.

3 Strategies for Compounding Wealth

#1 Increase your Offense

I’m going to use a sports or video game analogy here. A big factor affecting your path to $100K as quickly as possible is to do everything you can to increase your income, aka increase the amount of offense you can put out.

Regardless of your income level, your offense should be focused on building that wealth.

This is where you can take on continuing classes for certifications, new side hustles or freelance work, or try switching jobs if you have the opportunity to do so.

Another option is to invest your money in the stock market, real estate, or other businesses.

You can also develop a high income skill for the next year or so, and I detail exactly how you can think of that in my video from last year “how to go from $0 to $100K in a year” which I’ll link at the end of this video and down below.

The idea here is that your time should be spent thinking about how to use your time and resources to build wealth instead of spend it, which leads me to strategy #2 which is to: Play Good Defense.

#2 Play Good Defense

Quote on page 131 of the Millionaire Next Door: “If you cannot increase your compensation significantly, become wealthy some other way. Do it defensively.”

The whole premise of the book is that it studied the 95% of americans who had a net worth of $1 million or more in 1990 dollars - who were regular people who simply built wealth through a consistent, foundational lifestyle.

It found that many of the millionaires played good defense even if their income wasn’t as high as it could be.

So defense in this context means that we are figuring out strategically how to spend a less money. That means actionable items like planning the year ahead, budgeting, and cutting back on certain categories where we might spend too much.

For example, do you know how much you spent eating out last year? Most people don’t. But the vast majority of millionaires will know, despite most of them hating budgeting as well. Yet they still do it because they know its crucial to understanding their money situation.

#3 Strategy #3 is to maximize the efficiency of the dollars you DO have.

If you live in any western country, you know that the government loves taking a portion of your pay. In some countries it can be upwards of 50%, but here in America the top earners will usually pay 37% in federal taxes.

So an easy way to accumulate and keep more of your own wealth is to invest your money in a tax sheltered account like the Roth IRA - where your earnings grow tax free.

Or the Traditional IRA - which will help you reduce your tax liability by the amount that you contribute to it in that calendar year.

In many cases, if you’re able to get a tax shelter from paying the full amount of taxes that you owe to the government, you’re going to be increasing your wealth a lot faster than others.

Another efficiency is a high yield account.

If your cash is sitting in a bigger bank’s checking earning you 0.01% in interest, you best believe you should try to move some of that money to a high yield savings account earning you at least 4.5%*

* rates subject to change with Federal Funds Rate.