How To Go From $0 to $100,000 in A Year

In this article I will show you how I would go from $0 to $100K this year.

Sep 26, 2024

Business

15 min

Did you know?

51% of Americans have $5,000 or less in savings, while 1 in 3 (35%) have $1,000 or less in savings.

And according to a study in 2022, 56% of Americans cant cover a $1000 dollar emergency expense.

Now, having $100K can be life changing - but getting there is a whole nother story. According to Charlie Munger - the right hand man of Warren Buffett with a net worth of over $2.3 billion dollars, quote:

***The first $100,000 is a b*tch, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.***

*So let’s break this down - the quote hints at the fact that we need to save and be frugal in order to reach $100K as quickly as possible — he literally says to “walk everywhere” and “not eat anything”. Notice how he doesn’t say to “invest in Gold” or “yolo into gamestop stock”.*

The First $100K

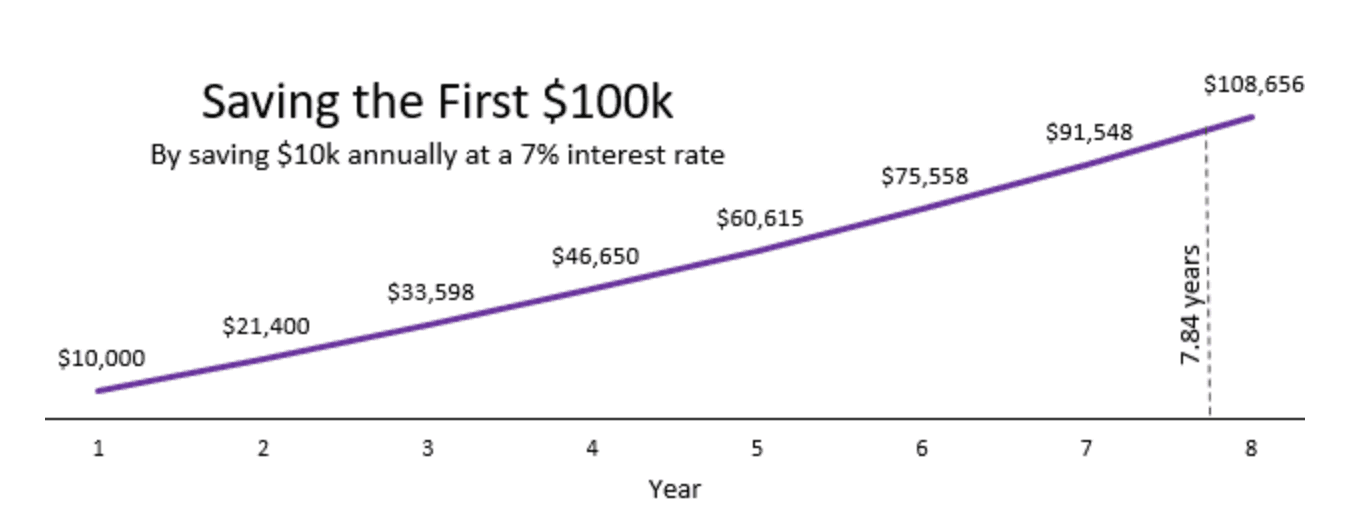

Contrary to what people believe, the first $100k is typically not derived from just investment returns in the market. Take a look at this calculator from the Four Pillar Freedom blog - I’ll link the blog in the description by the way.

https://fourpillarfreedom.com/four-visuals-volume-5-comparing-savings-vs-investment-returns/

If you save $15,000 a year for 6 years and you’re also able to attain a modest 4.5% return on your savings - you would be at $105k after 6 years but 85% of that would have been comprised of savings, and 15% is interest.

In another example, let’s say you save a lot less, $10k a year, but you average a 10% return. It will still take you 7 years and at a phenomenal 10% return, savings composes 67% of the total $104k here.

The point is - rarely is your first 100K just from investment gains. It’s actually from just saving, being smart with money, and earning more money throughout the years. The faster you want $100K, the more you need to save and less you need to invest. That’s why Charlie Munger’s quote really applies here - you want to amass it by ANY MEANS NECESSARY.

BUT the beauty is, after you get your first 100K, the next 100K is easier to make, and it’ll come faster.

Pretend you save $12000 a year, or $1000 a month - and you’re able to get 8% in the market.

Your first 100K will take you 6.25 years. Your next 100K assuming you keep investing and saving $12k a year would only take you 4.25 years. That’s 2 years faster because of the compounding effect of having $100K already.

Breakdown

Ok so if I wanted to get to $100K asap. I would break down this number in a bit more digestible of a manner.

$100K in a year is $273.97 cents a day. But if we only count business days, there are 260 working days in a year so that comes out to roughly $384 dollars a day. This is your target. You want to be able to make about $380-400 dollars a working day. Assuming you work 40 hour weeks, that’s an hourly wage of $48 dollars an hour. If you want to work 60 hours per week, its about $32 dollars an hour.

Ok so is this actually possible within a year? I would say… statistically no its not likely, but the idea is that I’m gonna try for it - because there are certainly people making this kind of money within a year. Why not me?

Irreplaceability

Let’s talk about how I would make $380 in a day - or roughly $48 dollars an hour. First I would start off by reading Hump Days, my free newsletter where we break down business and economy news twice a week - link is in the description and its completely free to sign up - we are just about to cross 10,000 readers.

Alright but for real, to make $380 a day - we need to talk about the concept of being irreplaceable.

The more irreplaceable you are, the more money you will make. It’s a reason why so many athletes make exorbitant amounts of money. Steph Curry, my favorite NBA player, signed a $215 million dollar contract back in 2017, why? Because you can argue that his skills in basketball are irreplaceable. He literally can’t be replaced. Who else is going to shoot 3 pointers from half court?

So Steph Curry is a huge asset to any NBA team, and is the reason why he was signed to a supermax contract. He drives value to the Golden State Warriors which has been valued at $7 billion dollars - the most valuable team in the NBA.

Contrast Steph Curry to someone selling concessions in the stadium. That person selling popcorn and drinks is not going to be paid as high as Steph Curry, thats an extreme example, but there are many hundreds if not thousands of people that could do the job of selling concessions.

In the eyes of the market and the economy this person just naturally won’t make that much because the skill is easily replaced and the pay will reflect that skill.

So in this way, we need to play to our strengths. What are our skills? What are our natural advantages?

Your High Income Skill

Whether we know it or not, we all have advantages and expertise in SOMETHING over another person. Think about your friends or family - there’s going to be things that you are naturally better at than they are, simply because you’ve spent more time doing them than your peers.

So if I took myself for example, at this point in my career I know a lot about a few things more than a majority of people. 1) gaming companies, since I used to monetize one of the highest grossing games in the world, 2) ecommerce since I started my own poster business, 3) finance and financial advisory since I used to be a FA, and #4) is social media and YouTube.

Does it mean I’m the single greatest person at these? Not even close. However, I do know more than someone starting out - for example. If I wanted to go out and consult YouTubers or Tik Tok’ers on how to grow their channels, I could conservatively charge $100-200 an hour for my knowledge, and same thing with helping people with their finances.

Could I charge people for my basketball skills? Hell no - I’ve probably played basketball for less than 20 hours in my entire life. Not even a 5th grader would pay me for that.

Now if you’re reading this, what you can do is take out a piece of paper and write down what you are good at - seriously, pause reading and try this right now.

For example, if you know a lot about building muscle, working out, and creating workout programs - think about the different ways you could monetize that skill.

You could do 1 on 1 personal training with people.

You could become an affiliate of fitness related products like supplements and clothing products.

You could start a website that offers free knowledge and sell a course on your workout programs.

You could start a Private Facebook Group where you have a community of like minded fitness people that you drive to your links.

But it all starts with knowing what you’re good at.

Now if you’re watching this and you really don’t think you’re good at anything - I doubt thats true, but for the fun of it lets say its true- what should you do?

This is where I would spend the next year or two building out a high income skill. There are so many skills and types of jobs that I know I can do from home and earn over $50 an hour in. I could become a graphic designer and help people with logos and branding, I could become a videographer, a copywriter, an online writer, a social media marketing manager, a web designer, etc.

You start small with these skills, build them day by day, and eventually you can scale them to 6 figure + businesses. Learning these skills can all be done online for free on websites like Hubspot Academy. For example they have a email marketing course you could take that teaches you the basics of email marketing that you could then use to apply for gigs online.

https://academy.hubspot.com/courses/email-marketing

I remember watching a CNBC Make It video from a year ago where this Fiverr freelancer was making $375 thousand dollars a year just writing. Her main income was derived from ghostwriting e-books and blog posts. https://youtu.be/hHhYtZV_T9M

While she is probably in the top 1% of all writers online, it doesn’t mean we need to be in the top 1% of anything to get us to our $100k goal.

We just need to get to a place where we’re earning more money, ideally above $50 an hour, and then combine it with cutting costs dramatically.

If I didn’t want to learn a new skill, I’d probably start a service based business that had the potential to scale. Some service based businesses are like dog-sitting, window washing, lawn mowing, cleaning gutters - stuff everyone can do. In all of these service based businesses, you start small to prove the concept, get to know customers and get some referrals. Eventually if I got to a point where I was booked like crazy for lawn services, I would then start to scale that business by adding an employee, and so on. But I want to point out that in this process, you are building the skill of starting a business, even if the action you are taking is not a new skill. so thats pretty cool.

Cutting Costs

Ok so you are figuring out how to be irreplaceable and earning more of an income. Now Let’s talk about the other side of the equation - costs.

This is where you need to live as frugal as possible on your way to 100K.

The dictionary definition of frugal is to be "careful about spending money or using things when you do not need to", in other words - we want to make sure we're getting the most value out of our dollar, pound, euro, or whatever currency it may be ESPECIALLY in the beginning because the beginning is the hardest.

You don’t have to be frugal forever, but I would say in the beginning you need to be thinking critically about all your decisions about money. No matter how small they seem.

Here’s a recent example that my friend thought I was crazy for.

I have the McDonalds app on my phone. I can get an iced coffee using the McDonalds app for $0.99 cents, no matter the size. The normal price is $2.29 cents or something like that, that’s more than DOUBLE the price. So while i’m only saving like $1.29, YES I will go out of my way to use the app to save that money. While that $1 and change isn’t going to change my life dramatically, nor would I even notice it, I find that its a microcosm of my overall financial behavior. I’m always trying to get the best possible deal if I can. That behavior will likely translate to the rest of my life. And that’s how you should be thinking when trying to amass the first $100K.

It’s the same reason why you see super rich frugal people still trying to save pennies on the dollar. That’s how they got there in the first place.

Now does this mean I’m cheap? Or that you need to be cheap? No. I think there is still enough room for select times where you can be generous and giving to others, but still frugal with your own personal spending.

So I want you to do this. Whenever you're about to spend money, think about if there's a less costly alternative to doing so. If you get a starbucks everyday, why don't you try making coffee at home? If you like eating out every meal, perhaps switch it up and meal prep for a week to see how much you could save? If you take an Uber to work daily, why don’t you try public transport? And my favorite… when you DO go out for lunch, keep it simple. Get the sandwich, but maybe skip the chips and the drink - this small decision will save you money over long periods of time.

It’s usually the tiny lifestyle changes that start to compound and help you save a ton of money.

Conclusion

So you’ve started to make more income, and cut costs… now what? Now it’s all about repeating the same process, investing the money you do have so that it can work for you, and then easing off the pedal a little bit - if you want to.